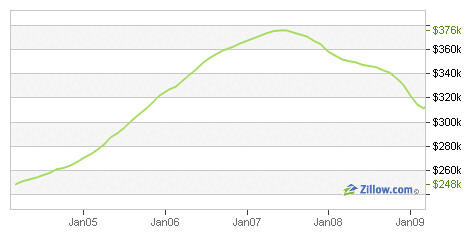

Below is a chart of home prices in my zipcode taken from Zillow

We bought our house around the peak of that chart. According to Zillow our home seems to have lost about $50,000 in value since we bought it. That seems high on the surface but I know of at least one house in our neighborhood that just sold for $60,000 less than what the owners paid for it around the same time we bought our house.

I don't expect that the recently announced home owner rescue plan by the Obama administration (which is covered in a great Q & A in the New York Times blog) will have any effect on us given that we can afford our house and aren't in dire financial straits. Unless I end up one of the 3,600 waiting for the other shoe to drop and can't find a new job. At least I'm no longer an H-1B so I don't have to worry about needing to leave the country within a week or two if laid off.

I expect house prices to drop even further before we hit the bottom. This is a rational expectation when you look at the following chart

None of this would be a concern if we plan to live here for the next 20 – 30 years. However I have a horrible daily commute and as a new dad I'm not enamored with the schools in the area.

So I punched some numbers into Pay Or Go: Walk away from your mortgage calculator and the result was a recommendation to walk away if we don't expect the house to appreciate back to the price we paid for it in the next 5 – 7 years. Given the historical chart above, I don't.

Articles like Silicon Valley 'underwater' homeowners: Should I stay or go? point out that the biggest consequence of walking away is having a blemish on your credit score for up to seven years. This implies to me that if moving to a neighborhood whose schools I feel better about is important then it makes sense to take the credit hit now, rent a place and put away the cost savings over the next seven years so we can have a great down payment when we want to move to that house in the great school district when Nathan will be about 7 years old.

On the one hand, I feel like I'm shirking some financial responsibilities even thinking about this but on the other hand I want to do what's best for my family. What do you guys think?

Now Playing: Bob Marley & The Wailers - Redemption Song

Now Playing: Bob Marley & The Wailers - Redemption Song